Poco F3 GT : Specification, Price, 5g Bands everything else!!!!!

How is Pan number Generated?

Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department, to any “person” who applies for it or to whom the department allots the number without an application.

PAN enables the department to link all transactions of the “person” with the department. These transactions include tax payments, TDS/TCS credits, returns of income/wealth/gift/FBT, specified transactions, correspondence, and so on. PAN, thus, acts as an identifier for the “person” with the tax department.

PAN was introduced to facilitates linking of various documents, including payment of taxes, assessment, tax demand, tax arrears etc. relating to an assessee, to facilitate easy retrieval of information and to facilitate matching of information relating to investment, raising of loans and other business activities of taxpayers collected through various sources, both internal as well as external, for detecting and combating tax evasion and widening of tax base.

A typical PAN is AFZPK7190K.

First three characters i.e. “AFZ” in the above PAN are alphabetic series running from AAA to ZZZ

Fourth character of PAN i.e. “P” in the above PAN represents the status of the PAN holder.

“P” stands for Individual,

“F” stands for Firm,

“C” stands for Company,

“H” stands for HUF,

“A” stands for AOP,

“T” stands for TRUST etc.

Fifth character i.e. “K” in the above PAN represents first character of the PAN holder’s last name/surname.

Next four characters i.e. “7190” in the above PAN are sequential number running from 0001 to 9999.

Last character i.e. “K” in the above PAN is an alphabetic check digit

How to Apply for a PAN Card Online on NSDL Website

If you are applying for a new PAN card, you will have to fill in Form 49A or 49AA depending on whether you are an Indian citizen or a foreign citizen. Keep in mind that this is primarily for applicants who don’t currently have a PAN card and have never applied for one. Here are the steps to follow:

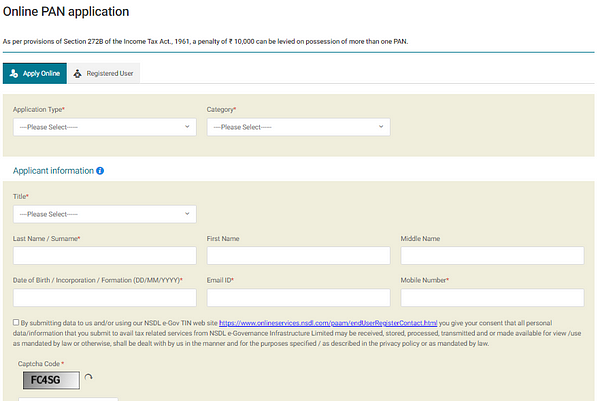

Step 1:Visit the NSDL website’s Online PAN Application section

Step 2: Select your application type: Form 49A (Indian Citizens) or 49AA (Foreign Citizens) or Changes or Correction in PAN/Reprint of PAN Card

Step 3: Select your Category. The options are Individual, Association of Persons, Body of Individuals, Trust, Limited Liability Partnerships, Firm, Government, Hindu Undivided Family, Artificial Judicial Person, and Local Authority. ( If you are making a pan card for yourself select Individual)

Step 4:Fill in the Title, Last name/surname, First name, Middle Name, Date of Birth/Incorporation/Formation in DD/MM/YYYY format, email ID, mobile number, and Captcha code. Submit the form.

Step 5:On the next page you will receive an acknowledgment with a token number. Click on ‘Continue with PAN Application Form’ on this page.

Step 6: You will be directed to fill in more personal details similar to Form 49A or Form 49AA. Input all the necessary information.

Step 7: Choose how you want to submit the documents. You can: a) Forward application documents physically; b) Submit digitally through digital signature; c) Submit digitally through e-sign.

Step 8: On the same page, indicate what documents you are submitting as proofs for identity, address, and date of birth. Confirm the declaration, place, and date of application. Review and submit the form. Make sure you make no mistakes.

Step 9: On the next page fill in all your contact details such as an address, phone number, email id(Mandatory).

Step 10: Select your AO code according to your area.

Step 11: Upload all of your documents in PDF format.

Step 12: On the next page You need to enter the first 8 digits of your Aadhaar card and verify all the details which you have uploaded.

Step 13: If you choose Demand Draft, you will have had to make a DD before you begin the application process as you have to provide the DD number, date of issue, amount, and the name of the bank from where DD is generated on the portal.

Step 14: If you choose Bill Desk, you can pay through Net Banking, and Debit or Credit Cards, You can also pay via UPI

Step 15: Click on ‘I agree to terms of service’ and proceed to pay. The PAN application fees will vary based on whether you are sending documents separately to NSDL or uploading online.

Step 16:If you pay by using your credit card or debit card or via net banking, you will receive an acknowledgment receipt and payment receipt. Print the acknowledgment receipt.

(not for online proof submission)Step 17:Attach two recent photographs along with the acknowledgment receipt.

(not for online proof submission)Step 18:After payment is confirmed, send the supporting documents via post or courier to NSDL

Step 18: After your payment, you will be redirected to a new page where you have type a otp which has been sent to aadhaar registered mobile number.

Enjoy!!!

Proof needed for applying for pan card

Photocopy of any one of these documents(For Address)

Photocopy of any one of these documents(For Identity)

Photocopy of any one of these documents(For Date of Birth)

If you want to apply for a pan card

Contact: technoyashas@gmail.com

Comments

Post a Comment